SELF-ASSESSMENT – A thorough understanding of the organization’s strengths, weaknesses and assets/resources available to it.

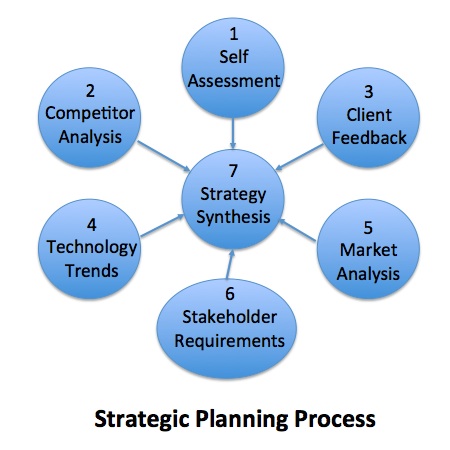

In STILE Point 23, we provided an overview of the 7 steps to developing a winning strategy shown in the figure below. The strategic planning process starts with the development or updating of the organization’s mission, vision and values and finishes with a strategy designed to fulfill its mission and achieve its vision. The mission is usually a variation of developing, deploying and exploiting science and technology to create value for the organization depending on the industry sector. In the case of government research institutions, the mission is often expanded to include recommending policies and commercializing technologies based on sound science to stimulate economic and social development.

STEP 1 SELF-ASSESSMENT: A thorough understanding of the organization’s strengths, weaknesses and assets/resources available to it.

STEP 1 SELF-ASSESSMENT: A thorough understanding of the organization’s strengths, weaknesses and assets/resources available to it.

STEP 2 COMPETITOR ANALYSIS: The strengths, weaknesses and strategy of competitors’ products and services fighting for the same market space.

STEP 3 CLIENT FEEDBACK: Intelligence from existing clients on their current problems and future opportunities and the value you bring to their organization.

STEP 4 TECHNOLOGY TRENDS: An awareness of competing and emerging technologies that could disrupt the strategy

STEP 5 MARKET ANALYSIS: A thorough knowledge of market and industry trends

STEP 6 STAKEHOLDER REQUIREMENTS: A clear understanding of additional stakeholder requirements which could include regulatory, political and social factors that could positively or negatively affect the organization’s license to operate and its brand image.

STEP 7 STRATEGY SYNTHESIS: Collecting and synthesizing the disparate data and information in steps 1-6 into actionable intelligence on which to make decisions.

The first step in the strategic planning process is conducting a self-assessment. The purpose of the self-assessment is to gain a thorough understanding of the organizations’ strengths, weaknesses, and assets/resources available to it.

On the surface, it would appear that conducting a self-assessment would be the easiest of the seven strategic planning steps to conduct. After all, all the data you need are readily accessible within your organization. It turns out that most self-assessments suffer from self-deception due to ignorance, arrogance or both. The larger the organization, the more difficult it is to get the critical information you need as it is often dispersed throughout the organization. Ignorance of key organizational strengths can often result in missing strategic opportunities. Ignorance of key organizational weaknesses can result in making poor decisions that adversely affect the success of the strategy during implementation.

On the other hand, too often senior managers suffer from overestimating the strengths and minimizing the weaknesses of their organizations. This arrogance, often a result of being enamored with a particular technology or disenchanted with the behavior of a technical team despite the value of their outputs leads to faulty decision-making.

Having been involved in leading several turnaround efforts in R&D organizations, I have developed a healthy skepticism for existing self-assessments. For example, one organization I was asked to turn around was losing key long-term clients and was convinced that the cause of its problem was that its costs were too high and blamed the organizations overhead rate. It turned out that the key managers had overestimated the quality of the products they were delivering to clients. When I spoke to several clients, they expressed disappointment with the quality and timeliness of deliverables. This lead to a key element of a strategy going forward to improve quality that resulted in recapturing several of client accounts and a return to profitability.

In another example, an organization that I took over had just experienced a major setback in a key strategic initiative. When I asked several staff scientists what they thought went wrong, they all expresses the same thought. “We knew all along that the strategic initiative wouldn’t work” and had convincing evidence to back up their claim. When I asked why this wasn’t brought to the attention of senior management, they said that when they expressed concerns at a meeting, management reaction was so negative that they thought best to keep their mouths shut.

One of my managers whom I admire once told me that the best managers have a bit of paranoia in them, always questioning whether their products and services are good enough and whether competitors are close to out competing them. This is good advice when conducting a self-assessment. Err on the side of caution by challenging all of the existing assumptions.

The three key evaluations to focus on are your (1) products/services, (2) key processes, and (3) people; the three P’s. When evaluating your products/ services there are only two fool proof, unbeatable strategies; having a desirable product or service that no one else has, or delivering your product/service at a lower cost than your competitors. While these are great strategies, they are rarely seen in today’s marketplace. Most strategies fall somewhere in between these extremes and require an honest, unvarnished assessment of the value that your product or service provides versus your competition (what the business community calls your value proposition).

Product/Service

Most R&D organizations’ strategies depend on having a superior product/or service based on the latest technology or sound scientific principles. This is a double edge sword. The lifecycle of technical products/services has been significantly shortened over the past decade. It is now not unusual to see product lifecycles in the one to two year timeframe rather than the more traditional seven to ten years.

During the data synthesis (Step 7), you will be comparing your present products/services to that of your competitor’s generated in Step 2, competitor analysis and your future products/services based on Steps 4 and 5, technology trends and market analysis.

Organizational Processes

The responsiveness and costs of your products and services are highly dependent on the organizational processes that support them (i.e. customer relationship management, project management, financial management). In my experience, this is the weakest link in the R&D delivery chain and negatively effects the cost and responsiveness in delivering products/services to clients. Improving the processes by which you deliver R&D products/services can have a dramatic effect on competitiveness and is worth the effort. Therefore, it is important to thoroughly evaluate each of your critical processes to be sure that they contribute rather than subtract from your products value proposition. Key questions include:

- Is the process well defined and documented and communicated widely?

- Does the process have an owner whose performance depends on its execution?

- Are there competent people managing this process and know their responsibilities?

- Are there control systems and KPIs measured?

- Are staff roles and responsibilities clearly documented?

- Are you getting positive customer feedback on the effectiveness and efficiency of the process?

- Is the process reviewed periodically for continuous improvement?

While not as exciting as developing a novel product/service, process improvements can have a dramatic effect on the success of your strategy since it is an area that is not traditionally emphasized by R&D organizations (your competitors).

People

Clearly, the moist important evaluation is of the people in your organization that make a difference, i.e. your leadership. It is your leaders that develop and deliver your products to clients through your organizational processes. In my mind, there are three critical questions that must have satisfactory answers during the self-evaluation step.

- Do we have outstanding talent leading each of our key products/services and are they happy and productive in their assignments?

- Do we have a pipeline of “ready now” backups for each of our key products/services?

- Are our key leaders given sufficient time to continuously develop their training and skills?

We all know that the business of R&D is based on innovation and our assets walk out the door each evening. Attracting and retaining top talent is the overriding secret to a successful R&D enterprise. An R&D organization left to its own will tend toward mediocrity as there is always some attrition of outstanding staff while mediocre staff rarely leave. It is imperative, therefore to be constantly on a talent search.

In evaluating your talent, it is useful to rate your key leaders using the attributes listed in Chapter four. Identify your “A” players in leadership, management and coaching and make sure that they have been placed in the appropriate leadership roles where they can utilize their unique strengths. Identify your “B” players and prepare a realistic development plan to improve their skill sets. The remaining staff need to find other work. During the evaluation process, it is critical to wean the organization of non-performers and ensure that the top talent is aligned with the organizations strategy and values.