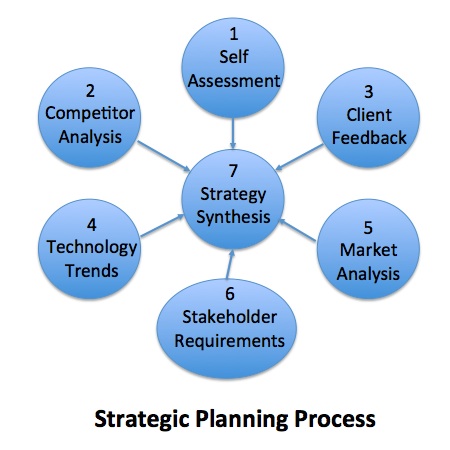

In STILE Point 23, we provided an overview of the 7 steps to developing a winning strategy shown in the figure below. The strategic planning process starts with the development or updating of the organization’s mission, vision and values and finishes with a strategy designed to fulfill its mission and achieve its vision. The mission is usually a variation of developing, deploying and exploiting science and technology to create value for the organization depending on the industry sector. In the case of government research institutions, the mission is often expanded to include recommending policies and commercializing technologies based on sound science to stimulate economic and social development.

STEP 1 SELF-ASSESSMENT: A thorough understanding of the organization’s strengths, weaknesses and assets/resources available to it.

STEP 1 SELF-ASSESSMENT: A thorough understanding of the organization’s strengths, weaknesses and assets/resources available to it.

STEP 2 COMPETITOR ANALYSIS: The strengths, weaknesses and strategy of competitors’ products and services fighting for the same market space.

STEP 3 CLIENT FEEDBACK: Intelligence from existing clients on their current problems and future opportunities and the value you bring to their organization.

STEP 4 TECHNOLOGY TRENDS: An awareness of competing and emerging technologies that could disrupt the strategy.

STEP 5 MARKET ANALYSIS: A thorough knowledge of market and industry trends.

STEP 6 STAKEHOLDER REQUIREMENTS: A clear understanding of additional stakeholder requirements that could include regulatory, political and social factors that could positively or negatively affect the organization’s license to operate and its brand image.

STEP 7 STRATEGY SYNTHESIS: Collecting and synthesizing the disparate data and information in steps 1-6 into actionable intelligence on which to make decisions.

The STILE Points 24, 25 and 26 we elaborated on the first three steps; self-assessment; competitor analysis, and client feedback. In the current STILE Point, we discuss the importance of developing an awareness of competing and emerging technologies that could disrupt your strategy. As discussed previously, R&D product life cycles are becoming increasingly shorter and today’s leading products can become obsolete in a very short period of time. It is therefore critically important to develop an awareness of technology trends that could affect your current and future R&D strategy. For purposes of discussion, I have divided these trends into three parts; incremental, transformational, and disruptive.

The first and easiest trend to monitor is the incremental one; the relative rate at which both you and your competitors are improving your existing products and services (i.e. making them better, faster and cheaper). Most R&D groups spend a considerable amount of resources (both staff time and money) in protecting their current product lines from competitor’s advances (as well as they should) by product differentiation (improving their product’s features) and process improvements (to produce their product faster and cheaper than their competition). When done well, this can extend the lifecycle of a product by several years.

As an example, I was asked to turn around Battelle’s Marine Sciences’ laboratory which had experienced such a trend. It found itself losing several proposals for large environmental monitoring and assessment projects despite having superior technical reports recognized by their clients. In debriefings with clients, I found that competitor’s bids were substantially lower in cost. After overcoming the initial reaction of denial, we examined several processes and found that nearly half of our costs were associated with the management and quality control of large data sets. This was at the time when a clear trend of automated data collection and information management systems was emerging. We decided to invest internal resources at considerable expense on a state of the art environmental information management system and were able to reduce our costs by a factor of three while improving overall data quality. These improvements resulted in recapturing most of that business and extending that product line for several more years.

When evaluating incremental technology trends, it is important to not only benchmark the relative competitiveness of existing products, but also the relative rate of improvement in product quality, cost, and speed to market. If you find that your current products are behind your competitors and your rate of product/process improvement slower, it may be time to either abandon that product or rely on your research team for a transformational technology to leapfrog your competition.

Depending upon your industry, a sizable portion of your research portfolio may be allocated to projects that target a transformational change in your product or service. Unlike incremental change, a transformational change involves a technology/marketing breakthrough resulting in an immediate and substantial competitive advantage. As mentioned in Chapter 5, justifying R&D spending that targets transformational change is challenging as most of these projects involve considerable risk. Financial managers are much more comfortable justifying return on investment calculations on incremental improvements. This is where having a balanced R&D portfolio consisting of projects with both short term (incremental) and long term (transformational) results makes sense.

An example of a transformational project that we were fortunate to have developed at Arthur D. Little was the first practical photo-toxicity and carcinogenicity evaluation using novel instrumentation for our client, Johnson and Johnson. We developed this instrument and used it to evaluate the toxicological effects of Retin-A and gained approval for its use by the FDA. This breakthrough set the standard for photo-toxicity testing in the US and helped us corner the market for several years.

Another example involved developing a combination of analytical tools (mass spectrometry and biomarker analysis) and reference materials to definitively characterize oil constituents (pure and weathered) in the environment which our scientists named “Environmental Forensics”. This expertise was used to track oil spills and assign potential culpability and was used extensively in the Exxon Valdes oil spill. This analysis transformed the process of Natural Resource Damage Assessment for oil spills internationally.

The final trend that needs to be monitored is the disruptive technology trend. Seemingly irrelevant emerging technologies can be innovatively applied to render your product, service and even your company obsolete. A good example of this is the Polaroid Corporation which for decades had a monopoly on instant photography based on hundreds of iron-clad patents on photochemistry. With the introduction of digital photography, instant photography became a commodity taking Polaroid from a market leader to essentially out of business. Similarly, Kodak, who had a commanding market share of the photographic film market found its film business disappear in a matter of a few years with the advent of digital photography.

There are currently several emerging technologies that appear to be on an exponential growth curve that will have a dramatic effect on practically every market segment. These include nanotechnology, biotechnology, bioinformatics, bioengineering, sensor technology, robotics, 3-D printing, artificial intelligence, advanced computational systems, and remote control technology. For an excellent and uplifting read on how many of these technologies may make this a better world, I recommend reading Abundance by Peter H. Diamandis and Steven Kotler. Each of these technologies have the potential of disrupting many existing technology-based companies and need to be constantly monitored.

Typically, such information on these disruptive trends is obtained from a variety of sources including technical conferences, patent searches, journal papers and the like. In addition to monitoring your own technology, you need to look beyond your field of specialization to develop both depth and breath of intelligence which leads to innovation. As mentioned in the beginning of this chapter, this is an ongoing process conducted by a variety of the organizations leadership including executives, staff scientists, program managers and marketing managers. Developing a knowledge management system that captures this information institutionally will help immensely when it comes to step seven, strategy synthesis.