COMPETITOR ANALYSIS – The strengths, weaknesses and strategy of competitors’ products and services fighting for the same market space.

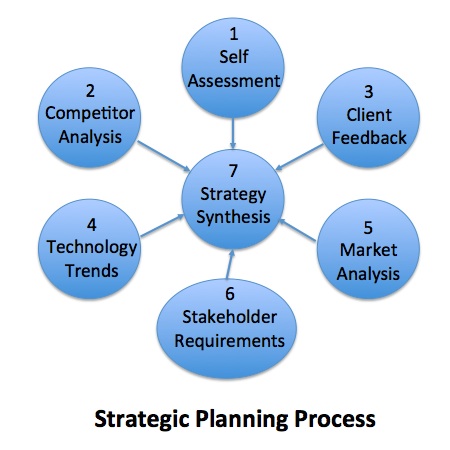

In STILE Point 23, we provided an overview of the 7 steps to developing a winning strategy shown in the figure below. The strategic planning process starts with the development or updating of the organization’s mission, vision and values and finishes with a strategy designed to fulfill its mission and achieve its vision. The mission is usually a variation of developing, deploying and exploiting science and technology to create value for the organization depending on the industry sector. In the case of government research institutions, the mission is often expanded to include recommending policies and commercializing technologies based on sound science to stimulate economic and social development.

STEP 1 SELF-ASSESSMENT: A thorough understanding of the organization’s strengths, weaknesses and assets/resources available to it.

STEP 1 SELF-ASSESSMENT: A thorough understanding of the organization’s strengths, weaknesses and assets/resources available to it.

STEP 2 COMPETITOR ANALYSIS: The strengths, weaknesses and strategy of competitors’ products and services fighting for the same market space.

STEP 3 CLIENT FEEDBACK: Intelligence from existing clients on their current problems and future opportunities and the value you bring to their organization.

STEP 4 TECHNOLOGY TRENDS: An awareness of competing and emerging technologies that could disrupt the strategy.

STEP 5 MARKET ANALYSIS: A thorough knowledge of market and industry trends.

STEP 6 STAKEHOLDER REQUIREMENTS: A clear understanding of additional stakeholder requirements that could include regulatory, political and social factors that could positively or negatively affect the organization’s license to operate and its brand image.

STEP 7 STRATEGY SYNTHESIS: Collecting and synthesizing the disparate data and information in steps 1-6 into actionable intelligence on which to make decisions.

In STILE Point 24, we discussed the first step in the strategic planning process, conducting a self-assessment. The purpose of the self-assessment is to gain a thorough understanding of the organizations’ strengths, weaknesses, and assets/resources available to it. In today’s STILE Point, we will discuss the second step in the process, competitor analysis.

Make no mistake, regardless of which type of R&D organization you belong to, you always have competition. Commercial in-house R&D laboratories must contend with competing products or the possibility of management outsourcing their product development or R&D services to contract R&D laboratories (CROs). CROs compete with each other for both government and private sector R&D funds. Non-government organizations (NGOs) compete with other NGOs for government contracts. Government R&D labs compete with each other for a piece of the Federal R&D pie.

Developing a winning strategy requires that your future products/services be better than that of your competitors competing in the same marketing space. Too often, R&D managers become so enamored with the elegance of a specific strategy that they ignore benchmarking the strategy with that of their competitors. It is important to keep in mind that even an excellent strategy can be beaten by an outstanding one and a pretty good strategy will always beat a mediocre one.

Competitor analysis involve the same three steps as self-evaluation: products/services, processes, and people. In performing the analysis and ultimately developing a strategy, you will want to identify areas where your strengths match up well with competitor’s weakness. These represent winning themes to emphasize in both developing and selling future products or services. As part of your strategy, you will need to counteract those areas where competitor’s strengths expose some of your weaknesses.

Competitor’s Product/Service

Before dismissing any competitor’s product/service, remember that there is a good reason why customers or clients are buying it. There are one or more features that make it better than your product/service in their eyes. In the case of a specific product, it can be quality, cost, ease of use, perceived effectiveness, or brand name. For research services, the differentiator’s can be even subtler such as a well-written proposal, established relationships and reputation of a specific Principle Investigator, responsiveness to a client’s needs or a proven track record of results.

The key question that needs to be answered is “what are the specific reasons why certain customers (in the case of products) or clients (in the case of services) purchase a competitor’s product/service over ours”? Answer’s can be found in examining the product or service itself (through reverse engineering) and obtaining feedback from customers that use their products or services.

While it is useful to compare your current product’s success with that of your competitor’s, it is even more important from a strategic point of view to predict the relative success of your future products and services in the pipeline to that of your competitor’s. This is a more difficult exercise, as the information is harder to get (but not impossible). Much information on new products can be gleaned from the literature, patent searches and your competitor’s own product literature.

Competitor’s Organizational Processes

The best way to evaluate a competitor’s processes in relation to yours is to measure relative outcomes. Do they produce their product faster, cheaper and of a higher quality than you do? This is a good indication of the competitiveness of their manufacturing process. Do they provide a more responsive and value added research services than you do? This is a good indication of their project management process. Do they win more research projects than you do? This is an indication of the quality of their proposals. Do clients prefer doing business with them? This is a good indication of their client relationship management process.

As mentioned previously, a good knowledge management system that you can refer to during the planning process is invaluable as the information needed is normally generated over a period of years by a broad spectrum of staff. When conducting a customer or client review, questions concerning your organization’s quality, responsiveness, price, and value are asked in a relevant context; i.e. compared to each of your competitors. The data and information obtained in these reports become useful for both the self-assessment and competitor analysis.

Competitor’s People

As discussed previously, the key differentiator in any R&D organization is the quality and motivation of its leadership. Leaders develop the products, oversee the services and manage the processes by which the organization competes in the marketplace. I have always felt that over the long run, R&D organizations compete not on the basis of their products or services but on the quality of their leadership.

I know that in the R&D services business, sophisticated clients buy people not organizations. So regardless of the money spent on company branding and advertising, it’s the specific people in the organization that attract business. When managing a contract bio-pharmaceutical development laboratory, my clients would ask for specific study directors by name as a condition of getting their business.

It is a good practice to get to know your competitor’s key leadership as well as you knows your own. I routinely made it a practice to take one or more of my competitor’s key leadership to lunch at least once a year (often at a technical conference). We would often share stories about common clients and issues that we were facing in our own companies. While protecting company secrets, we were willing to give each other useful information that made these meetings worthwhile.

My motive was always based on recruiting. I would ask my competitor how happy he was in his current position and whether or not he would be interested in a job offer from our company. The common response was that they were very happy with their current jobs. Those were the very people I was interested in recruiting; talented, successful leaders who were happy with their work. Inevitably over the years, situations changed and I was able to hire several of these recruits along with the clients that they brought with them.

Leave A Comment