Gaining intelligence from existing clients on their current problems and future opportunities and the value you bring to their organization.

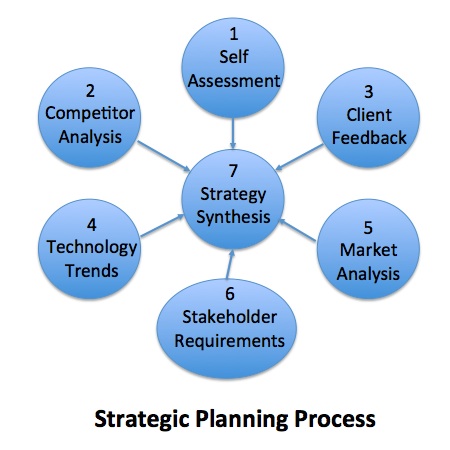

In STILE Point 23, we provided an overview of the 7 steps to developing a winning strategy shown in the figure below. The strategic planning process starts with the development or updating of the organization’s mission, vision and values and finishes with a strategy designed to fulfill its mission and achieve its vision. The mission is usually a variation of developing, deploying and exploiting science and technology to create value for the organization depending on the industry sector. In the case of government research institutions, the mission is often expanded to include recommending policies and commercializing technologies based on sound science to stimulate economic and social development.

STEP 1 SELF-ASSESSMENT: A thorough understanding of the organization’s strengths, weaknesses and assets/resources available to it.

STEP 1 SELF-ASSESSMENT: A thorough understanding of the organization’s strengths, weaknesses and assets/resources available to it.

STEP 2 COMPETITOR ANALYSIS: The strengths, weaknesses and strategy of competitors’ products and services fighting for the same market space.

STEP 3 CLIENT FEEDBACK: Intelligence from existing clients on their current problems and future opportunities and the value you bring to their organization.

STEP 4 TECHNOLOGY TRENDS: An awareness of competing and emerging technologies that could disrupt the strategy.

STEP 5 MARKET ANALYSIS: A thorough knowledge of market and industry trends.

STEP 6 STAKEHOLDER REQUIREMENTS: A clear understanding of additional stakeholder requirements that could include regulatory, political and social factors that could positively or negatively affect the organization’s license to operate and its brand image.

STEP 7 STRATEGY SYNTHESIS: Collecting and synthesizing the disparate data and information in steps 1-6 into actionable intelligence on which to make decisions.

In STILE Point 24, we discussed the first step in the strategic planning process, conducting a self-assessment. The purpose of the self-assessment is to gain a thorough understanding of the organizations’ strengths, weaknesses, and assets/resources available to it. In STILE Point 25, we discussed the second step in the process, competitor analysis, in order to evaluate the strengths, weaknesses and strategy of competitors’ products and services fighting for the same market space. In the current STILE Point, we discuss the importance of client feedback in gaining intelligence from existing clients on their current problems and future opportunities and the value you bring to their organization.

Once again, if you work in R&D, you always have a customer for your product or client for your services. For commercial companies, internal customers can include your R&D manager, your company’s marketing department, or senior management. External clients can include venture capitalists or angel investors. For CRO’s and NGOs, clients include private and public sector funding organizations. The concepts discussed in this chapter are quite universal in that R&D success is highly dependent on satisfying current client expectations and anticipating their future needs better than your competition.

The best and most strategic information to help with your strategic planning efforts will come from customer or client feedback. From your current client base, you can get a pretty comprehensive picture of how well you stack up in their eyes versus your competition. It is also one of the important paths to assess market trends and stakeholder requirements. Being close to the customer was one of the key success factors in Peterson’s book, In search of Excellence, Lessons from America’s Best Run Companies.

Before discussing the type of feedback you need from clients, it is important to select the client base from which to survey. Most R&D organizations err on selecting too many or too few clients from which to obtain feedback. Many organizations conduct a client feedback survey on all of their completed projects with the hope that the average result will yield a composite picture of their client’s satisfaction. In other cases, there is no formal mechanism to obtain client feedback and very little interaction with clients above the level of project manager.

The first step in obtaining valuable client feedback is to select a subset of your client base that is most important to your current and future business success. I will refer to this set as key clients. Criteria for selection of key clients is company specific, but include such measures as volume of current business, technology leadership, market and industry leadership, and anticipated new business. It is important that the list be manageable, 5-10 clients, because it takes a great deal of time and effort to build trusting long term relationships with them. Starting with new clients, your relationship should grow from being one of many venders to a preferred provider and ultimately to a strategic partner.

Once you have selected your list of key clients, you need a codified process for building a relationship with those clients. This usually involves selecting a key client account manager whose role is to serve as an ambassador between the client and your company. As ambassador, he would be the face of your company, providing information and advice when asked and directing inquiries to the appropriate technical staff. He would also be the in-house expert on the client’s strategy, organization, problems and opportunities.

As an R&D Director, I made it a point of meeting with my key clients at least once a year along with my key client account manager. I would review the list of projects conducted for that client over the past year and thank the client for their business. I would then ask for feedback on three levels.

Level 1 – How would you rate the quality, responsiveness and value of the products/services that we have provided over the past year on a scale of 1 to 10? How does this compare to our competition? The scores on quality will assess your product, scores on responsiveness will assess your processes and scores on value will evaluate the justification for your costs. Level 1 measures how well you are currently serving your clients. A key follow-up question that I have found to be extremely useful is to ask what your organization would specifically have to do to improve your scores. This is a method of extracting valuable information even when the client has given you a high rating.

Level 2 – Where do you see your market going in the next few years and the products/services you will be needing from us? This is an open ended question that probes clients about the future and creates a dialog where you can introduce new ideas. This can be very helpful in generating your research agenda in the strategic plan.

Level 3 – What level of impact is our research having on your organization’s strategy? What more can we be doing to become a strategic partner? This question can stimulate a discussion around the more difficult problems that the client is facing or opportunities that he wishes to pursue and whether he trusts you well enough to share these with you.

The information gleaned from these client reports should be incorporated into your knowledge management system and form the basis for making strategic decisions in step 7 of the planning process.

Leave A Comment